Becoming Healthy with Nan Shan

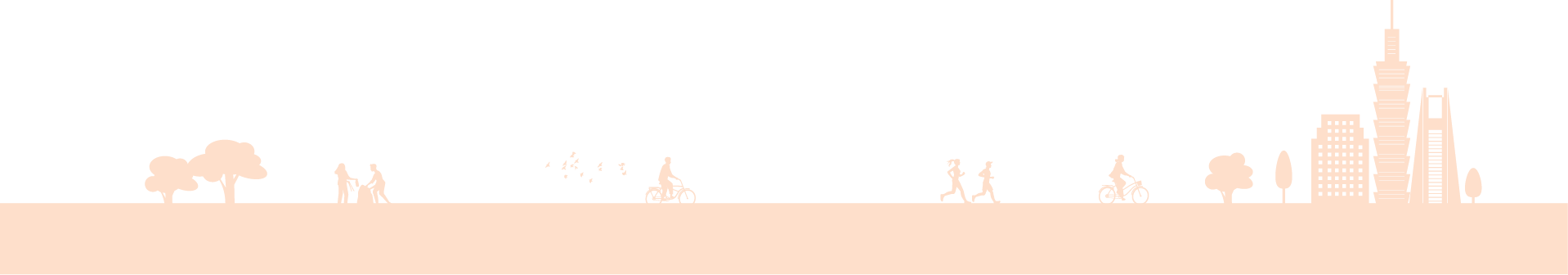

To fully realize the insurance industry‘s mission of public service and health promotion, Nan Shan Life established the Health Protection Circle in 2020. This initiative offers clients a wide range of health services across two major areas: Wellness and Healthcare. The Wellness services target healthy and sub-healthy individuals, with a primary goal of maintaining overall public health, supporting the development of a healthy life journey, and delaying the onset of illness. The Healthcare services focus on individuals with illnesses or disabilities, providing a comprehensive medical care system to support their recovery.

Through the Health Protection Circle, we have moved beyond the traditional role of financial compensation (i.e., claims payouts) to deliver comprehensive services that combine “pre-event prevention” and “post-event compensation.” By addressing client pain points, we aim to empower insurance with value added services - ultimately enhancing the health and well-being of both clients and society at large.

Through the Health Protection Circle, we have moved beyond the traditional role of financial compensation (i.e., claims payouts) to deliver comprehensive services that combine “pre-event prevention” and “post-event compensation.” By addressing client pain points, we aim to empower insurance with value added services - ultimately enhancing the health and well-being of both clients and society at large.

Health Protection Circle Platform

In July 2022, Nan Shan Life officially launched the online Health Protection Circle Platform, featuring a simple and intuitive interface designed to present rich content and provide one-stop access to a wide range of health and care information - meeting clients‘ needs. The platform has continued to show steady growth in traffic, with 210,000 visits recorded in the first six months of 2022. This number rose to 1.17 million in 2023 and further increased to 1.87 million in 2024, representing an approximate year-on-year growth of 60%.

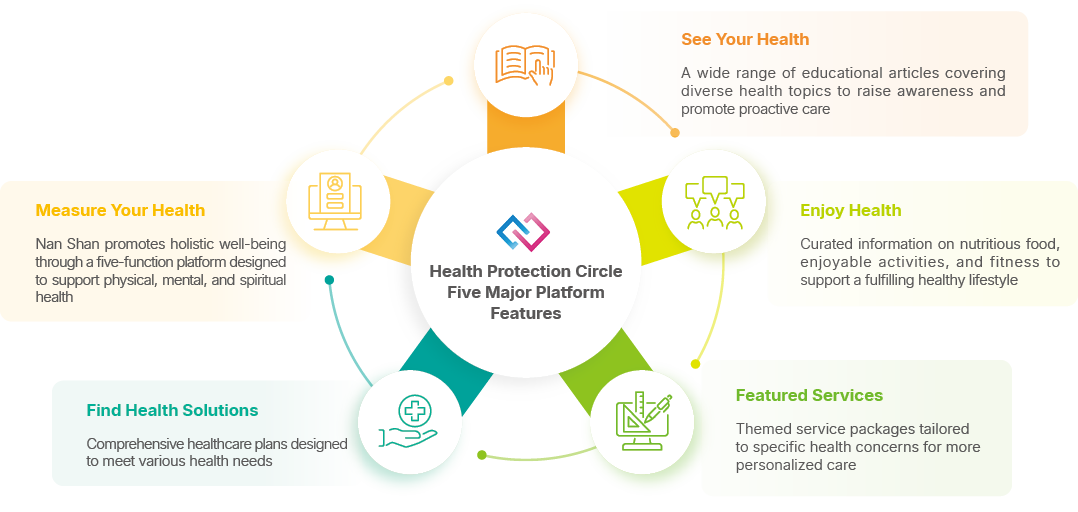

2024 Heartwarming Care Service Packages

Exclusively available to Nan Shan clients, eligible individuals may receive complimentary wellness or medical care services provided by Health Protection Circle partners. Since the program’s launch and through the end of 2024, the themed webpage recorded 37,821 visits. During the year, 13,927 clients used the service, with a cumulative beneficiary count reaching 36,541.

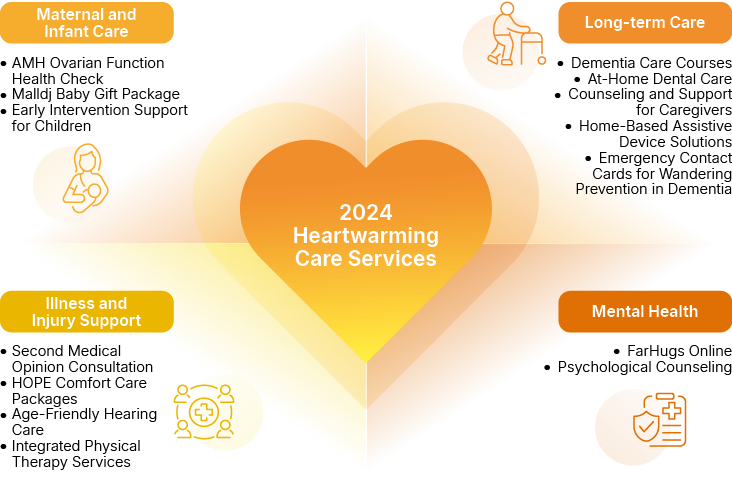

Mommy’s Fertility Assist Program – Maternity and Infant Care

In modern society, the trend toward late marriage and delayed childbearing has become increasingly prevalent, posing challenges for many women in planning for pregnancy. In response, Nan Shan's Health Protection Circle launched a comprehensive maternity and fertility care program to provide full-spectrum support, from preconception preparation to postpartum and early childhood.

I “Can” Help - Cancer Care Support

Nan Shan’s Health Protection Circle has long championed cancer care support. In September 2024, we launched a new themed webpage titled as I “Can” Help, designed to reduce the distance between individuals and cancer resources. From cancer prevention and active treatment support to post-treatment recovery, the platform offering corresponding health care solutions for cancer prevention, active treatment, and post-treatment recovery.

BAM App

With a strong commitment to advocate for regular exercise habits and promoting better health management, Nan Shan Life launched the BAM App in late 2019. The app tracks five key health indicators (daily step count, BMI, active calories, sleep duration, and resting heart rate) to calculate a user’s daily "biological age reduction result." The platform presents data through an intuitive physiological age interface, gamified map-based tasks, and a reward mechanism, all designed to help users record their health data, improve personal health, develop exercise habits, and amplify their wellness influence via in-app social features.

The Map of LOHAS – Elderly Service Zone

In a super-aged society, attention must be paid not only to physical and mental health but also to well-being and quality of life for the elderly. In response, Nan Shan Life’s Health Protection Circle developed the Map of LOHAS, inspired by the concept of a “Nan Shan LOHAS Village.” This digital platform integrates resources from our partner ecosystem to provide a one-stop service directory for “villagers” (elderly clients and caregivers). Users can explore the site from a first-person perspective in a role-playing simulation interface, making health navigation more engaging and intuitive.

Excellent Insurance with Nan Shan

Nan Shan Life is dedicated to building a comprehensive insurance protection framework while promoting healthy behaviors and concepts. We aim to shift insurance from “post-incident compensation” to “pre-incident prevention,” developing more innovative health and life insurance products with spillover effects through the integration of digital tools. We further analyze big data to identify client profiles and protection gaps. Through market segmentation and targeted development, we create diverse protection-oriented products tailored to the needs of different client groups.

By combining insurance with spillover-effect mechanisms, we are advancing a “new style of healthy living”

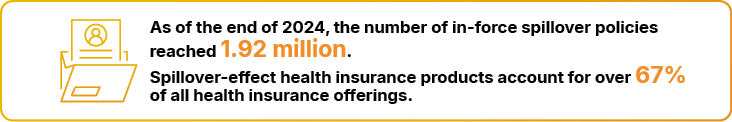

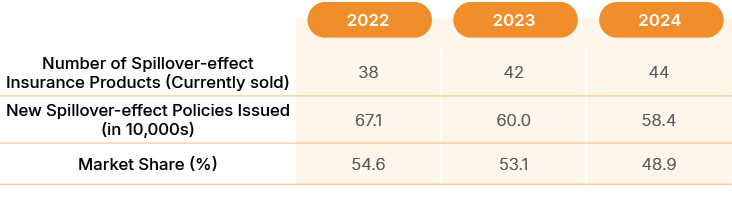

Nan Shan Life’s spillover-effect health and medical insurance now covers a wide range of areas, including hospitalization indemnity, hospital and surgical reimbursement, surgeries, dread diseases, specific illnesses, cancer, long-term care, dental coverage, and sub-optimal health. We have also extended the concept of health promotion into life insurance products. By incorporating reward systems, that encourage regular screenings and health management, empowering clients to enjoy not only insurance coverage but also continuous health improvement. Nan Shan Life has steadily increased the number of spillover-effect insurance products and continues to earn strong support from clients. In 2024, approximately 580,000 new spillover-effect insurance policies were sold, securing the number one position in new contract volume for six consecutive years.

Performance of Spillover-effect Insurance

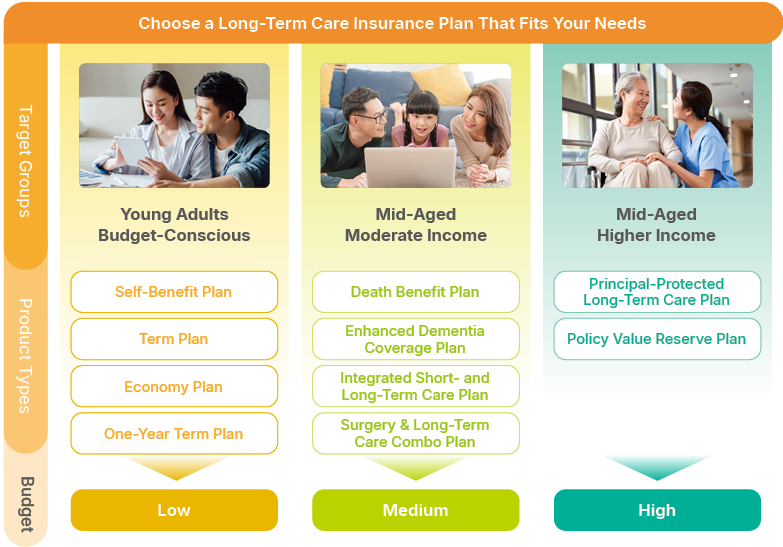

Diversified Long-Term Care Insurance

To accommodate diverse needs, certain products combine long-term care protection with death benefits, medical coverage, or life insurance cash value features. To enhance prevention, Nan Shan Life pioneered the industry’s first dementia-enhanced long-term care insurance, extending protection to include mild dementia. These products also incorporate spillover incentive mechanisms, encouraging clients to engage in proactive health management and reduce their future long-term care risks.