Nan Shan General Insurance continues to promote socially beneficial insurance products, offering comprehensive protection for individuals, households, and organizations.

A socially beneficial insurance scheme

To extend social care and assistance to vulnerable groups, and respond to the inclusive financial policy promoted by the Financial Supervisory Commission, Nan Shan General has launched the first micro property insurance in Taiwan, the Fire Difficulty Alleviating Insurance. Nan Shan Life Charity Foundation will donate premiums to low-income and middle-income policyholders in Taiwan with their residences damaged by a fire accident, with a fixed amount of NT$8,000 per person, to guarantee basic food and temporary accommodation of policyholders.

An environmentally friendly insurance scheme

Nan Shan General has launched the Residential Green Energy Upgrade Clause to encourage policyholders to take green actions by providing incentives such as preferential premiums, so as to create a sustainable environment and implement low-carbon living together with customers.

This product mainly applies to policyholders of Nan Shan General Residential Fire and Earthquake Basic Insurance, Nan Shan General Integrated Residential Insurance, and Nan Shan General Integrated Household Insurance. Policyholders are covered by the Residential Green Energy Upgrade Clause after paying the insurance premium. In the event of an insurance accident that causes damage to the insured subject, the policyholder may choose to repair or rebuild the insured subject with green building materials and equipment, and the claim amount can be increased to 150% of the total claim amount calculated based on the main insurance contract.

This product mainly applies to policyholders of Nan Shan General Residential Fire and Earthquake Basic Insurance, Nan Shan General Integrated Residential Insurance, and Nan Shan General Integrated Household Insurance. Policyholders are covered by the Residential Green Energy Upgrade Clause after paying the insurance premium. In the event of an insurance accident that causes damage to the insured subject, the policyholder may choose to repair or rebuild the insured subject with green building materials and equipment, and the claim amount can be increased to 150% of the total claim amount calculated based on the main insurance contract.

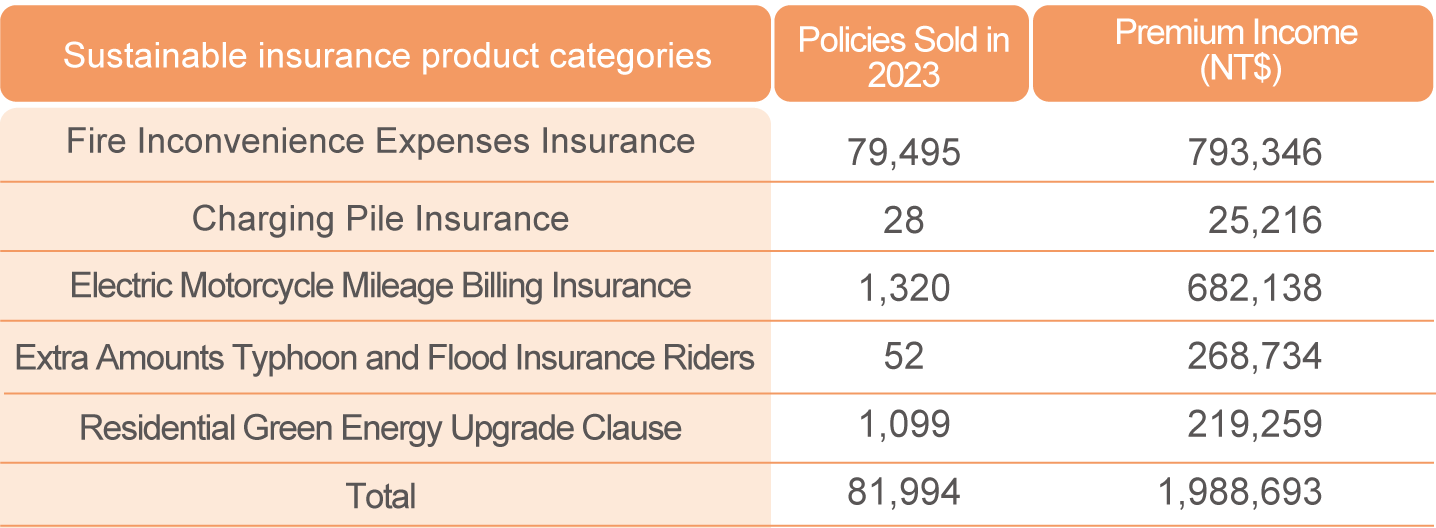

Driving Performance